Sound investment strategies have always been about more than just generating a return. They also focus on preserving those returns and minimising any factors that can eat into your profits. And one factor that can greatly influence your net return is taxation.

This is where investing in a Portfolio Investment Entity (PIE) can be helpful.

IMMEDIATE TAX ADVANTAGE

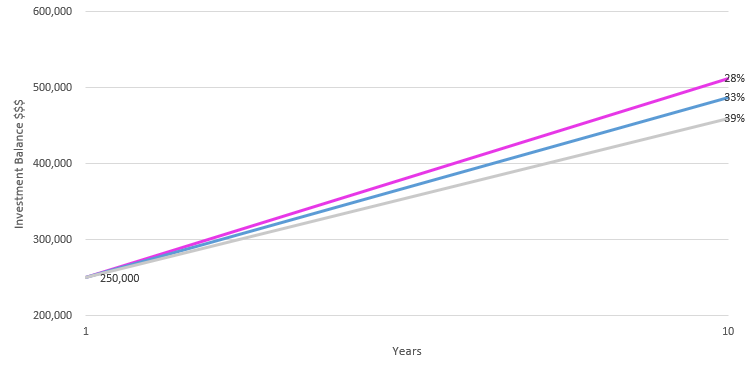

As you know, the PIE pays tax on behalf of its investors at a maximum rate of 28%. This structure provides a tax advantage for high-income earners taxed at 39% and for many Trusts, which will see their tax rate rise from 33% to 39% starting from 1 April 2024.

COMPOUNDING TAX BENEFITS

The benefits of a PIE investment become even more significant when you take into account the compounding effect of these tax savings over the long term. The graph below shows the compounding impact of the PIE tax rate vs 33% and 39% tax rates, assuming a 10% p.a. net return.

Like to learn more about the Wholesale 1 PIE Trust and why we chose the PIE structure? Get in touch – we will be happy to have a more detailed discussion.

Note: This article is intended to provide general information and does not constitute financial advice. We recommend you speak with a financial adviser for advice tailored to your individual circumstances. Investors must qualify as Wholesale Investors as that term is defined in sections 3(2)(a) – (c) or 3(3)(a) of Schedule 1 of the Financial Markets Conduct Act (“FMCA”). The Trust is not suitable for retail investors.