The Merx Private Credit Fund is a debt fund designed by investors for investors. The portfolio strategy and approach have been developed and refined over the years through our own investing experience—testing theories and structures with our own funds.

We first started in the invoice finance sector but found that while high-yielding, it was challenging to build a portfolio of decent scale in that space. Alongside this, our network had been referring general business and property loan opportunities to us. It was a natural pivot to focus on building and maintaining this as the core of our portfolio. We moved into business and property development finance and began amassing considerable experience in assessing lending scenarios and client objectives and managing the balance between risk and return.

In 2022, after 10 years of refining our lending and investment model, we opened the opportunity to investor partners: the Merx Private Credit Fund was born.

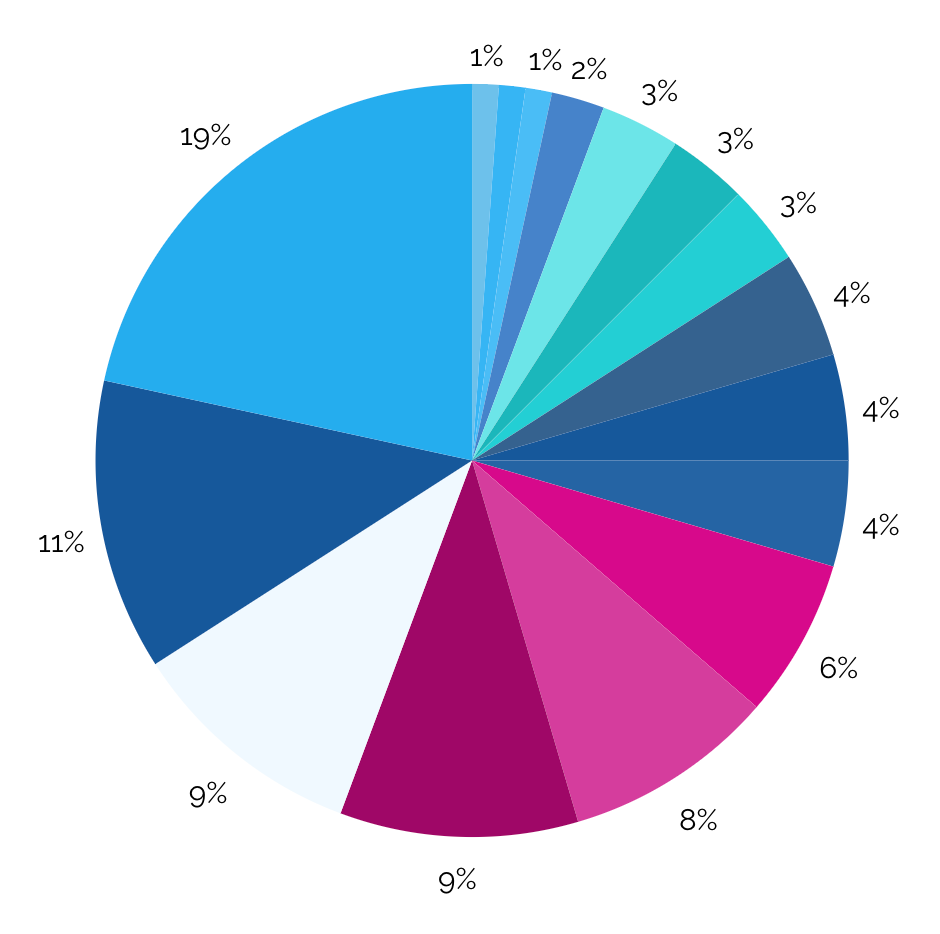

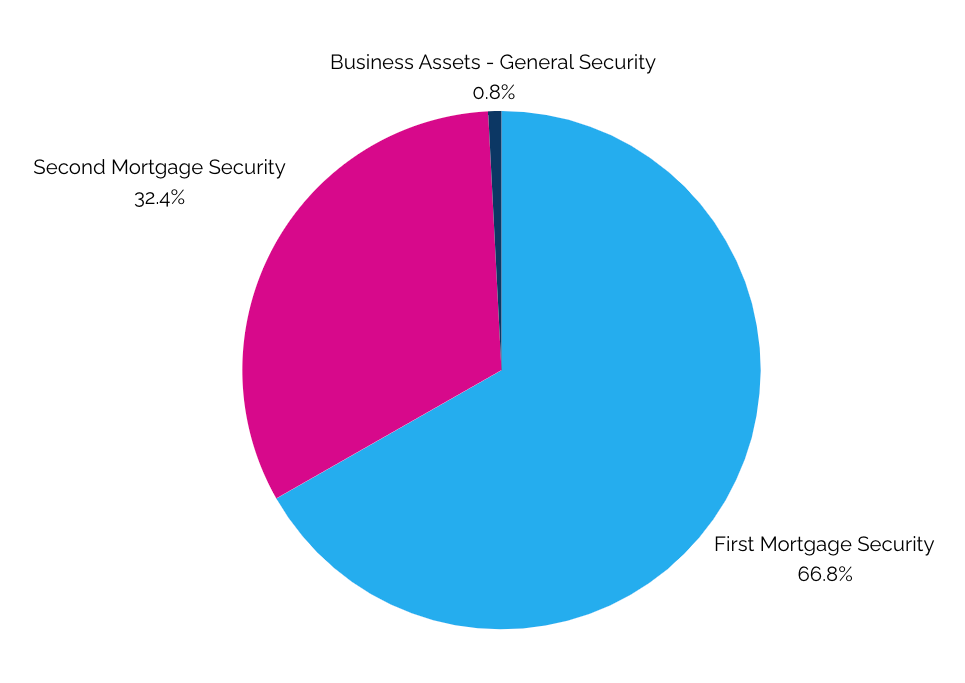

Our portfolio strategy is to maintain an optimal mix of lower and higher-yielding investments to balance safety and enhancing returns. As the graph below illustrates, a large proportion of the total portfolio is comprised of low-yielding, low-risk investments (first mortgage secured), which generates a good base to work with. This is then topped up by high-yielding short-term investments (second mortgage and business asset secured), which turn over frequently and boost returns.

Loan Portfolio Composition | Spread of Loans

31 March 2024

Loan Portfolio Value by Security Type

31 March 2024

To date, this strategy has delivered healthy returns for investors* and supported our ability to help business owners and property owners realise their plans with a short-term injection of funds.

To better understand the ‘assets’ the fund invests in – in our case, the loans Merx makes to business owners and property developers – take a look at our recent article on Managing Risk and Reward, and we welcome you to click here to view examples of finance solutions we have implemented in the first quarter of 2024.

Like to find out more?

We welcome you to get in touch. Contact the Merx Private Credit Fund management team here.

*Past performance is not a guarantee of future performance. The fund was established on 30 June 2022 and made its first investments in September 2022.

Note: This article is intended to provide general information and does not constitute financial advice. We recommend you speak with a financial adviser for advice tailored to your individual circumstances. Potential investors with Merx must qualify as Wholesale Investors as that term is defined in sections 3(2)(a) – (c) or 3(3)(a) of Schedule 1 of the Financial Markets Conduct Act (“FMCA”). The Trust is not suitable for retail investors.