As an investor, it’s crucial to understand the risks involved in an investment. At Merx, we ensure that the loans our Debt Fund invests in are secured. We take security over business or property assets to give us options to recover our investment if things don’t go to plan.

What Security Protects My Investment?

A common question from prospective investors is whether our loans are secured. The answer is yes. All loans in the Merx Wholesale Pie Fund are backed by security against local business and property assets.

Our evaluation process for finance applications is thorough, ensuring each investment is suitable for our investors. However, rigorous assessment alone does not fully mitigate risk; the security of our investments is crucial.

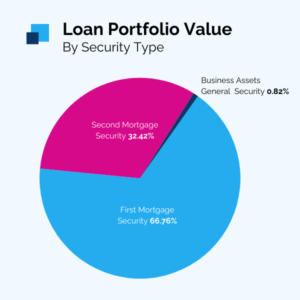

Over 99% of our loans are secured by either First Mortgages or Second Mortgages over property. As outlined in the March Quarterly Report, 66.76% of these loans have First Mortgage Security, and 32.42% have Second Mortgage Security. The remaining 0.82% is secured against Business Assets and General Security over all present and after acquired property of our borrowers. As a matter of principle, we always take personal guarantees as security for our loans.

“Easy to lend it, hard to get it back…”

The Merx debt fund invests in loans. There is an old saying that it is “easy to lend [money], it can be hard to get it back.” Our thorough vetting process and formal process of taking security to protect our loan investments are important steps to mitigating risks in our loan investments.

The Track Record?

Our assessment process and strong security requirements have resulted in a reliable track record. In our 11 years of lending in this space, we have advanced over $200 million in loans. Our total losses through this time have amounted to less than $75,000 representing just 0.04 percent of lending. Notably, there have been no losses in the Merx Wholesale 1 PIE Trust – Debt Fund.

In short, at Merx, we combine rigorous assessment with strong security measures to safeguard our investments and minimise risk.

If you’d like to know more about the debt fund, or have queries as a current investor, don’t hesitate to get in touch.

Note: This article is intended to provide general information and does not constitute financial advice. We recommend you speak with a financial adviser for advice tailored to your individual circumstances. Investors must qualify as “wholesale investors” as defined in Schedule 1 of the Financial Markets Conduct Act 2013. The fund is not suitable for retail investors.