Happy financial new year! As we roll into a new financial year, it’s a good time to pause, review and think about what lies ahead.

Despite continued uncertainty in the market, our outlook remains cautiously optimistic. The goal is to continue to keep our investors’ funds safe and generate strong returns. The way we are structured means we are insulated from what is going on in the broader wholesale funding markets and the global banking issues. We will continue to operate with our interests aligned with those of our investors. The managers’ family funds are committed alongside our investors to ensure this is maintained.

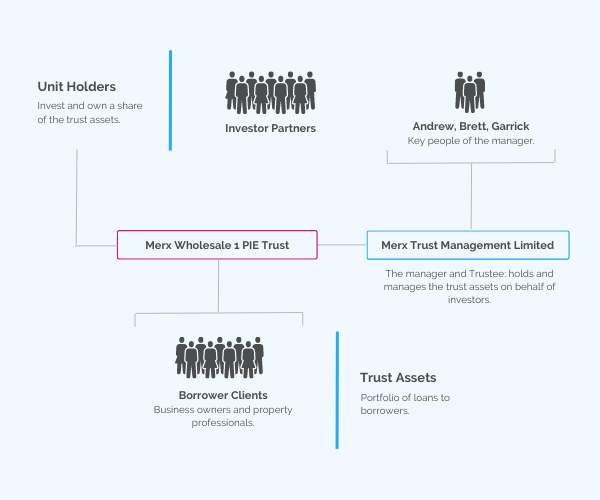

Here we delve deeper into the structure of the Merx Wholesale 1 PIE Trust, why it has been established this way, and how that benefits our investors. If you would like to discuss or introduce new wholesale investors who might like to partner with us, do contact us.

THE UNIT TRUST STRUCTURE: WHY THIS IS BENEFICIAL FOR INVESTORS.

We like to keep things simple and transparent. We also want to ensure the fund managers’ interests are aligned with investors’. The Unit Trust structure is well suited to this for the following reasons:

- Simplicity and Transparency – Investors own units in the pot of loans, and unit holders are the ultimate beneficial owners of the Trust’s assets.

- Professional, experienced manager – The Merx team hold and manage the trust’s assets for the unitholders (investors). We have been investing our own funds into the underlying investment assets (loans) for 10 years. The unit trust structure allows our investor partners to share in these investment opportunities alongside us.

- Alignment of interests – The Merx management team and their families also invest into this fund.

- Tax efficiency – The PIE structure can make the investment more tax efficient for most of our investor partners.

- Diversification – We invest in a range of loans to unrelated business owners and property investment professionals within the single asset class unit trust.

What do we invest in?

The trust invests in loans to business owners and property investment professionals, with diversification across the loan and borrower types reducing risk concentration for our investing partners. An investor in this trust has beneficial ownership of the underlying assets (portfolio of loans), providing an efficient and flexible investment vehicle for investors.

More on keeping your investment safe: diversification and liquidity.

With unit holders owning a share of the total portfolio of loans rather than being exposed to an individual loan as in peer-to-peer lending or a small share of a single asset as in property syndication, there is less concentration of risk, more liquidity in the investments, and more flexibility for investors.

Additionally, the Merx Wholesale 1 PIE Trust invests in a number of separate loans across a diverse range of unrelated borrowers and risk profiles. This diversity can help to protect our investors from potential market volatility and ensures a more robust and resilient investment.

Alignment of interests – we are all in this together.

The Merx team invest alongside investors in this fund. This approach aligns our interests with those of our investors.

We are committed to offering transparent and effective investment opportunities to our partners, and the unit trust structure is central to achieving this goal.

Give us a call on 09 215 9364 or email us at [email protected] if you’d like to set up a time to talk.